States with Increasing Minimum Wage as of July 1, 2017

States whose minimum wage rates will increase as of July 1, 2017 include:

- Maryland: $9.25/hr (Montgomery County and Prince George’s County have separate rate increases set to occur as of October 1, 2017 - see chart for details)

- Oregon: $10.25/hr (Portland goes to $11.25/hr and nonurban counties go to $10.00/hr)

- Washington DC: $12.50/hr

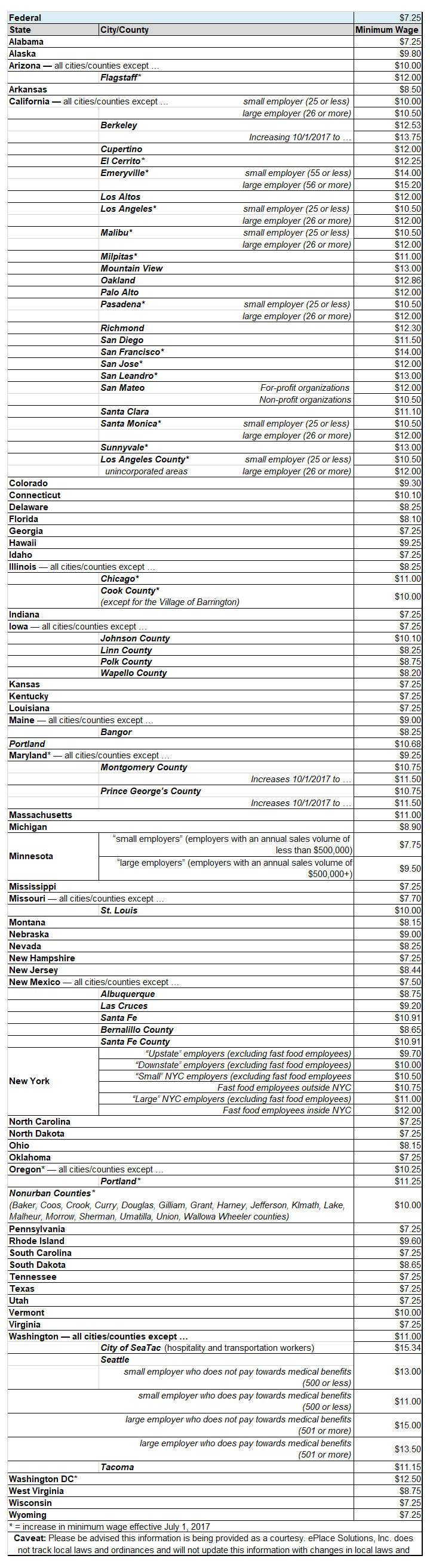

Several other cities and counties will also see minimum wage increases as of July 1, 2017. Please see the chart below for details.

States that Pay the Federal Minimum Wage

States whose minimum wage rates do not exceed the federal minimum rate of $7.25/hr include:

- Alabama

- Georgia

- Idaho

- Indiana

- Iowa (with the exception of several counties; see chart for details)

- Kansas

- Kentucky

- Louisiana

- Mississippi

- New Hampshire

- New Mexico (with the exception of several cities/counties; see chart for details)

- North Carolina

- North Dakota

- Oklahoma

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

- Wisconsin

- Wyoming

Local laws and ordinances may be different than the outlined information. If an employee works in an area with a higher minimum wage than the federal standard, the higher rate should be paid.

Minimum Wage for Tipped Employees

Federal minimum wage for tipped employees is $2.13/hr, provided that this hourly rate combined with tips equals at least the federal minimum wage. Several states have specific laws in regards to tipped employees found here.

Youth Minimum Wage

Workers under the age of 20 can be paid a minimum wage of $4.25/hr for the first 90 consecutive calendar days of employment when their work does not displace another worker. After 90 days, the teen must receive at least the federal minimum rate of $7.25/hr.

For questions about minimum wage or help with other wage and/or compliance matters, please contact our certified HR experts at HR@stratus.hr.