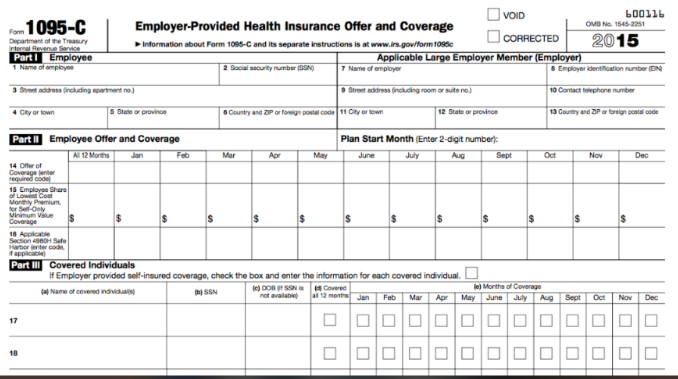

Ringing in the New Year brings an array of compliance reporting for the Affordable Care Act (ACA), but many employers are less aware of what to provide employees regarding ACA disclosures. At the top of this list is Form 1095-C, a form that employees will need when completing their individual tax information. All applicable large employers (ALEs) with 50+ full-time employees should provide Form 1095-C to employees, but do your employees know about this form and what to do with it when it arrives?

Beginning January of 2016, all ALEs must report health insurance information and provide annual statements to employees about their compliance. Form 1095-C contains information about an employee’s qualifying health coverage, which is needed for Line 61 when filing individual tax returns. Although employers won’t need to file this form with the IRS until Feb 29th (or March 31st if filed electronically), employees must receive copies of this form by Jan 31st. Form 1095-C should be retained with tax documents and shared with anyone assisting with tax preparation.

Because this is the first time employees will be receiving Form 1095-C, employers may want to implement a communications plan to promote awareness. Here is the basic message to convey to your employees:

- Here’s what to expect. You will receive a new form (Form 1095-C) for the first time this year that will be mailed out by January 31, 2016.

- Why you should care. This form provides healthcare information that you will need when preparing your 2015 individual taxes.

- Be on the lookout. Watch for the form in your mailbox sometime in January or early February.

Our Stratus.hr experts will be sending out notification to employees about Form 1095-C prior to mailing out W-2s, and all qualifying Stratus.hr co-employees will be receiving Form 1095-C postmarked no later than Jan 31, 2016. Click here for more information about Form 1095-C, or contact our benefits team.