What Is Intermittent FMLA Leave?

When employees qualify for FMLA but need to take time off in smaller blocks of time, it's called intermittent leave. Here’s how it works.

Here are some tips as a small business owner on how to award pay increases while factoring in performance to reward top employees.

When you are a small business owner, it can be hard to know how and when to award pay increases, particularly ones that are tied to performance like a merit pay increase. While most companies provide at least an annual wage increase to maintain competitiveness, how and why you give a pay increase on an annual basis can greatly affect the impact of both the salary boost and performance evaluation.

Our advice: strategically plan pay increases to ensure you are using the best system possible to link pay to performance while also encouraging the achievement of specific company goals and rewarding top performers. Use the following three-step system as a guide to help you get started.

A merit increase is a type of pay raise awarded to employees based on their exceptional performance. Unlike standard cost-of-living adjustments, merit increases are directly tied to an employee’s performance and are typically determined during performance review periods. This type of pay raise serves as a strategic tool for organizations to recognize and reward employees who demonstrate superior performance.

By linking pay to performance, merit increases incentivize employees to excel in their roles, thereby enhancing overall productivity and aligning individual efforts with the company’s goals. Merit increases are a critical component of employee compensation strategies, playing a significant role in employee retention and motivation.

When considering employee compensation, it's important to differentiate between a merit increase vs pay raise. Merit increases reward employees for exceptional performance; pay raises, such as cost of living adjustments, focus on addressing external factors like inflation or regional cost differences.

When an employee relocates to a more expensive city, a pay raise through a cost of living adjustment ensures their salary matches the increased expenses. Alternatively, if the employee’s performance exceeds expectations, their compensation can reflect this through merit pay differentiation.

To implement merit pay increases effectively, it’s crucial to follow a structured approach. Here is our 3-step guide to ensure your merit pay differentiation strategy is fair, sustainable, and aligned with organizational goals.

Annual merit-based increases typically begin with the company setting a proposed budget. This is followed by managers' assessments of their employees' performance, which should be based on specific performance metrics.

Metrics used in merit-based pay raises may vary between jobs, roles and teams, or they may be company-wide, but they should tie into company and team goals. It is also a good idea to make employees aware of the evaluation metrics at the start of the period being reviewed so they fully understand expectations. Some companies take this a step further and have employees set their own goals (usually in consultation with management), which they are then evaluated against.

Work with your certified HR expert to provide guidance on performance metrics, help structure performance evaluations with merit pay increases, and create a meaningful performance review program custom-tailored to your company.

Merit pay increases should be structured to fairly reward high-performing employees similarly across the company to reduce the risk of salary-increase inequality. Since pay increases are most frequently made as a percent of salary, that would mean a high-performing web developer would receive the same percent increase as a high-performing line worker.

Using analytics to determine merit can help ensure that performance evaluations are objective and data-driven.

Also consider the employee’s performance scorecard, current pay rate (whether they are above or below the company’s pay midpoint), and the proposed budget for merit increases. Each of these may affect the percentage your company can award an individual team member.

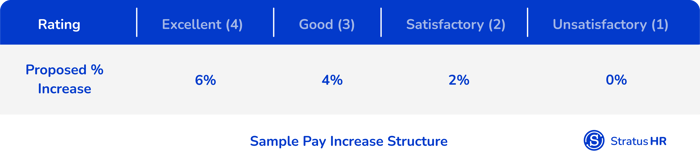

The following example shows how pay increases may be structured:

How did the employee perform through the year? Determining whether an employee was a high performer (i.e. excellent vs. satisfactory) requires creating a scorecard.

Creating a scorecard allows managers to objectively assess employee performance, ensuring that evaluations are fair and unbiased. Your management team will determine how well each employee completed performance metrics. Note that some companies start this process with the employee conducting a self evaluation, which is then forwarded to his or her manager for approval or modifications.

Your scorecard may weigh some of the evaluation criteria more heavily so that more important goals are given greater value, which ultimately impact the employee’s overall performance “score” more.

Merit pay increases offer numerous benefits for both employees and employers that increase loyalty and retention.

For employees, receiving a merit pay differentiation finally provides a sense of recognition and validation for their hard work and dedication. This not only boosts their morale but also fosters a sense of loyalty and commitment to the organization. Workers are more likely to stay with a company that acknowledges their contributions, which reduces employee turnover.

For employers, merit increases are a powerful tool that boost retention and productivity. By rewarding high performers, companies can motivate their workforce to strive for excellence, thereby improving overall performance.

Merit increases also help align employee performance with business goals, ensuring that everyone is working towards the same objectives. Additionally, retaining top performers through merit increases helps avoid costs associated with hiring and training new employees.

In the event your company only has “top performers” after performance reviews, it may be time to revamp your performance scorecard.

To encourage managers to truly highlight the top performers over the satisfactory and low ones, you may want to shift your performance management system to a bell curve. For example, only allow 20-25% to be considered top performers, 60-65% are midrange, and 10-20% are under performers.

Regularly reviewing your performance management system can help determine whether merit increases are effectively motivating employees and enhancing performance.

Other modifications may include the following:

In addition to individual performance, all employees may be rated on the company’s overall achievement of a key metric. For example, 60% of an employee’s pay increase may be based on company financial metrics, whereas 40% of the merit increase may be based on the employee’s performance review.

Pay increases may go beyond a bump in base pay. Cash recognitions may also be given throughout the year in the form of spot bonuses or other variable pay options awarded to high performers.

These can be a great way to extend the impact of merit-based pay for a company with budget limitations and allow rewards to flow throughout the year. This may also help prevent the creation of a culture of expectation, where employees have stopped seeing a performance-related pay increase as merit-based.

Unlike annual cost-of-living pay raises, which tend to happen at the same time each year, merit increases are not always tied to a calendar. That means you can choose to conduct these as your company sees fit -- either on a set date or time period, on an employee's anniversary date, or as needed.

Also understand there is no law regulating how or when you should increase an employee's pay, outside of minimum wage and other FLSA regulations, although pay increases are frequently considered a valuable tool in building employee retention and loyalty. To be competitive with the market, be sure to research the average merit increase to ensure an employee's pay differentiation finally becomes more than a cost of living adjustment.

Effective communication of merit increases is crucial to ensure transparency and fairness in the process. Employers should clearly outline the criteria for achieving merit pay and the projected increase amount or range. This information should be communicated to employees during the onboarding process, midyear and annual performance evaluations, and any time the policy changes.

Training managers on the merit pay policy is also essential. Managers should understand how to support their direct reports in meeting the requirements for merit increases. Regular updates and feedback are vital to ensure that employees are aware of their progress and understand the merit increase process.

By maintaining transparency and providing regular updates, employers can foster a culture of trust and motivation, encouraging employees to work towards achieving their goals.

Compensation strategies should never be decided on a whim, particularly when pay is used as a motivation for employee performance.

Understanding how an employee's performance financially impacts the business is crucial when structuring merit pay increases.

When structuring your program’s performance review/merit increase plan and timing, keep the following guidelines in mind:

Pay increases that are used to motivate employees are most effective when they are tied to performance, in contrast to cost-of-living increases.

Performance-based increases should be awarded shortly after a performance review to emphasize the connection between performance and pay.

Before starting or revamping a merit-based pay increase system, consult with your certified HR professional. Not a current Stratus HR client? Book a free consultation and our team will contact you shortly.

When employees qualify for FMLA but need to take time off in smaller blocks of time, it's called intermittent leave. Here’s how it works.

Per the Fair Labor Standards Act, certain time spent on the job must always be paid - even if it includes waiting or travel time or tasks done from...

Discover the unseen financial burdens of employee turnover and learn effective strategies to avoid them. Equip your business for better talent...