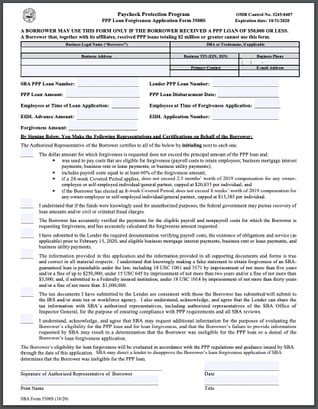

On October 8, the Small Business Administration (SBA) released an amended application (Form 3508S) for eligible business owners seeking forgiveness from their Paycheck Protection Program (PPP) loan. This simplified form omits the burden of computing the eligible loan forgiveness amount and requires less documentation from the borrower.

Who is eligible to use the simplified SBA application Form 3508S for PPP loan forgiveness?

Business owners with a PPP loan total of $50,000 or less are eligible to use the simplified SBA Form 3508S application. If, however, your individual business had a loan of less than $50,000 but you have affiliated businesses with PPP loans totaling more than $2 million, you are not eligible to use Form 3508S.

Which form do I use if I’m not eligible for this new simplified form?

If your individual PPP loan exceeded $50,000 or your affiliated businesses had PPP loans totaling more than $2 million, you should apply for loan forgiveness using SBA Form 3508 or 3508EZ. See more details about loan forgiveness.

What information do I need to complete the simplified SBA Form 3508S application for PPP loan forgiveness?

The simplified form first asks for basic loan information details, including:

- SBA and lender loan numbers

- PPP loan amount

- PPP loan disbursement date

- Employees at time of loan application vs. time of forgiveness application

- Economic Injury Disaster Loan (EIDL) advance amount and application number (if applicable)

- Forgiveness amount

(For more details about each of these requirements, please see the PPP Loan Forgiveness Application Form 3508S Instruction Form.)

Borrowers must then certify the following details about the actual PPP loan:

- Forgiveness amount doesn’t exceed the principal amount of the PPP loan

- The PPP loan was used to pay for costs that are eligible for forgiveness (payroll, business mortgage interest, business rent or lease payments, or business utilities)

- Payroll costs were at least 60% of the loan forgiveness amount

- Compensation for any owner-employee or self-employed individual/general partner doesn’t exceed $20,833 if seeking forgiveness for a 24-week period, or $15,384 for an 8-week period

The final six questions ask the borrower to certify that the information they provided to their lender is true, accurate, and consistent with tax documents provided to the IRS.

What documentation do I need to submit along with the new PPP Loan Forgiveness Application Form 3508S?

Per the PPP Loan Forgiveness Application Form 3508S Instruction Form, borrowers must submit the following payroll and nonpayroll documentation with Form 3508S.

Payroll Documentation for Form 3508S: Documentation verifying eligible compensation and benefits during the covered or alternative payroll covered period, including:

- Bank account statements or payroll service provider reports documenting cash compensation paid to employees

- Tax forms or payroll service provider reports

- Payroll tax filings

- State quarterly business and individual employee wage reporting and unemployment insurance tax filings

- Payment receipts, cancelled checks, or account statements that document employer contributions to employee health and retirement plans included in the forgiveness amount

Nonpayroll Documentation for Form 3508S: Documentation verifying obligations or services prior to February 15, 2020 and eligible loan forgiveness payments, including:

- Business mortgage interest payments

- Business rent or lease payments

- Business utility payments

Borrowers must retain all necessary documentation for six years after the loan is forgiven or repaid in full, with the expectation that any authorized SBA representative or Office of Inspector General may access these files at any time upon request.

For questions about the new PPP Loan Forgiveness Application Form 3508S, please contact your certified HR expert.

The SBA has released a simplified application for PPP forgiveness (Form 3508S) for loans of $50,000 or less.

Related articles: