While many small businesses have already gone through the process of applying for a PPP loan, some lenders are pushing back to have all companies, including PEO clients, provide a Form 941 for their second PPP loan.

The SBA, in consultation with the Department of Treasury, created a list of FAQs published on June 25, 2020 to clarify borrower and lender questions concerning the implementation of the Paycheck Protection Program (PPP). Question 10 applies particularly to PEO clients:

Question: What if an eligible borrower contracts with a third-party payer such as a payroll provider or a Professional Employer Organization (PEO) to process payroll and report payroll taxes?

Answer: SBA recognizes that eligible borrowers that use PEOs or similar payroll providers are required under some state registration laws to report wage and other data on the Employer Identification Number (EIN) of the PEO or other payroll provider. In these cases, payroll documentation provided by the payroll provider that indicates the amount of wages and payroll taxes reported to the IRS by the payroll provider for the borrower’s employees will be considered acceptable PPP loan payroll documentation. Relevant information from a Schedule R (Form 941), Allocation Schedule for Aggregate Form 941 Filers, attached to the PEO’s or other payroll provider’s Form 941, Employer’s Quarterly Federal Tax Return, should be used if it is available; otherwise, the eligible borrower should obtain a statement from the payroll provider documenting the amount of wages and payroll taxes. In addition, employees of the eligible borrower will not be considered employees of the eligible borrower’s payroll provider or PEO.

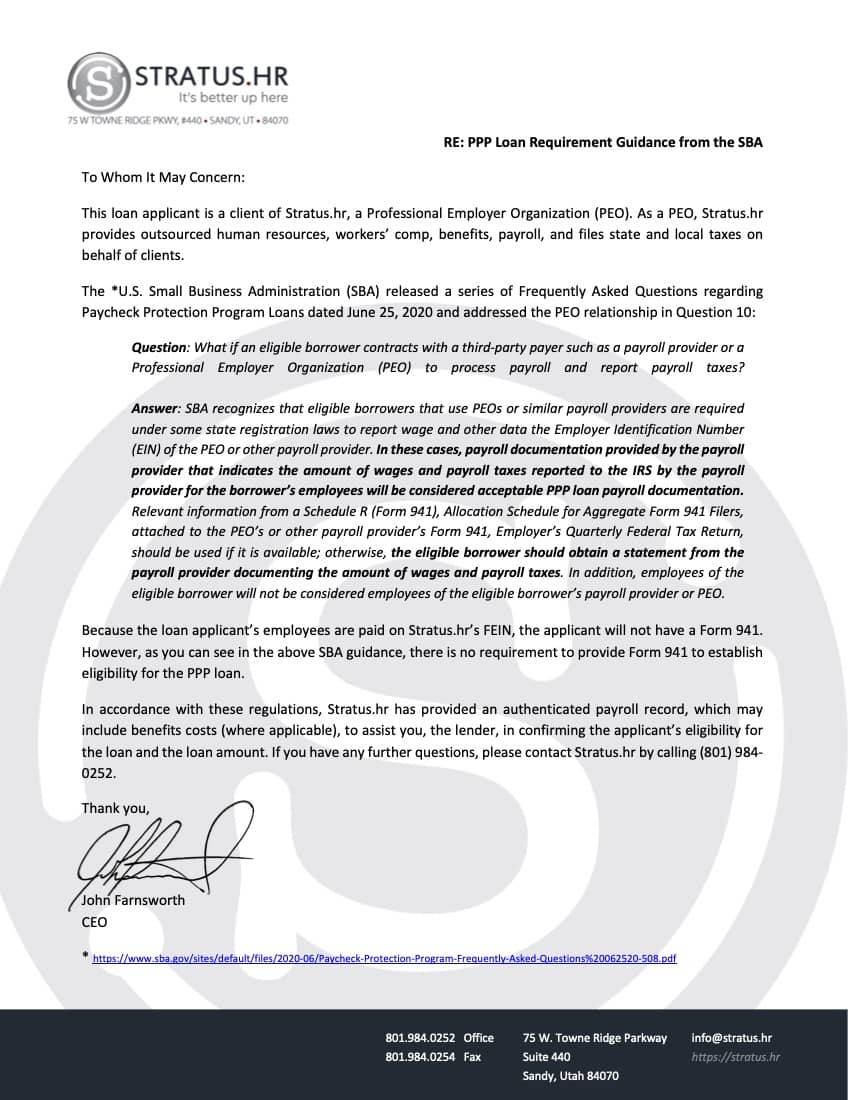

While this guidance issued by the SBA does not require tax documents, some lenders are requiring 941s for Payroll Protection Program (PPP) loan applications to verify payroll amounts for PPP loan purposes. Stratus.hr has drafted a letter to make this point clear for our PEO clients to use with lenders.

Please feel free to use this letter with your lender to address their requirement of providing a Form 941. For further assistance and/or more information about PPP loans, please contact your certified HR expert.