Just as the coronavirus pandemic has left its imprint on nearly every aspect of “normal life,” the unprecedented velocity of the market swings that created the COVID market crisis over the last few months caught many investors in its snares. Here’s a quick recap of where many investors went wrong and what you can do to avoid their same fate.

Covid-19 struck the stock market like a bolt of lightning

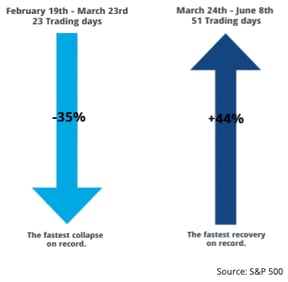

From February 18 and March 23, 2020, the stock market fell by over 35%. Never before in our nation’s history have markets fallen so far, so fast. Never! Not even during The Great Depression. In fact, of the top 5 largest daily percentage declines in the past 50 years, #2 and #3 both occurred in March of 2020.

On March 23, 2020, the markets finally hit their low point. But nobody knew the steep downward trend would soon come to a halt.

Investors sell record number of stocks the same day markets tank

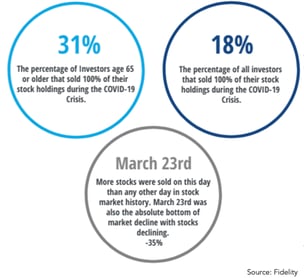

On March 23, 2020 when the markets bottomed out, more investors sold more stocks than any other day in market history. The exact wrong decision at the exact wrong time could not have been more perfectly timed.

The next day, the markets had the largest 1-day percentage gain (nearly 40%) in over 85 years on their path to recovery.

During this period in late Q1 and early Q2 of 2020, Fidelity reports that 18% of all investors sold 100% of their stock positions. Even more tragic, nearly one-third of investors age 65+ either in retirement or nearing retirement sold 100% of their stock positions. Instead of weathering the storm, they succumbed to their fear of the unknown.

Markets fight back at record speed

Nearly as dramatically and unprecedented in the course of market history, the market went up over the next 30 trading days more quickly than it ever has in such a short time period. If you were vacationing on Mars since February and just looked at market returns for the year, you would assume it was a relatively quiet year with some downside after such strong returns in 2019.

How can you avoid a similar man-made disaster?

We are walking a COVID market tightrope at the moment. Many are trying to balance the needs of opening the economy back up while keeping the virus in check. The future has always remained unwritten, but the potential paths forward now are just too divergent to make any grand tactical adjustments.

If your portfolio was built correctly and your unique circumstances have not changed dramatically due to current economic conditions, the investment strategy that was right for you before the Covid-19 crisis is still correct for you today. It will most likely still be correct for you after the crisis has ended.

In other words, stay the course and avoid impulse selling.

Is that storm on the horizon past us or just now gathering strength? We don’t know. Nobody knows. But like most elements of life, you need to hold on even tighter when you think you can’t hold on any longer.

If you currently have no investment strategy or need help with your situation as we wade through the unknown, please contact your financial advisor for specific guidance.

Original content and images provided by 401(k) Advisors Intermountain

Related articles: