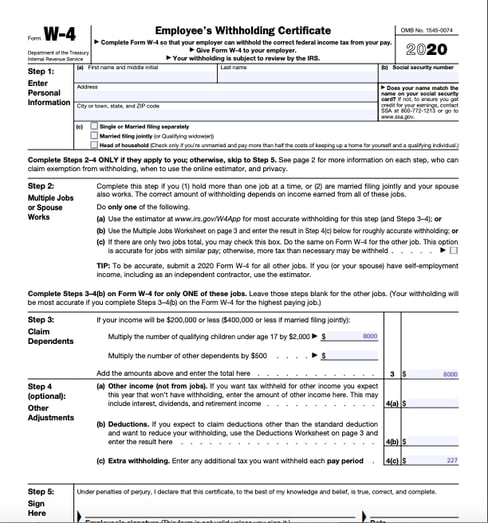

The IRS recently issued a new, redesigned Form W-4 that looks drastically different from the former version. While the IRS says it “reduces the form's complexity and increases the transparency and accuracy of the withholding system,” there’s a bit of a learning curve.

Here’s what you (and all employees) need to know.

1. Steps 2, 3 and 4 of Form W-4 are optional!

Of the five steps listed on Form W-4, you only have to complete Steps 1 and 5. You don’t even need any tax forms to provide answers! It’s simply your name, address, social security number, filing status, and signature.

This will set a standard withholding amount to be deducted from your paycheck. The amount is based on wages and filing status, with no additional adjustments needing to be made.

2. If you do complete Steps 2, 3 and 4 --- only do it for the highest paying job.

If you work multiple jobs or are married filing jointly with a spouse that works --- AND you want to more accurately identify your total tax liability --- only complete Steps 2, 3 and 4 on the W-4 of the highest paying job. All other jobs should simply have Steps 1 and 5 completed.

3. You don’t need to complete a new W-4 unless you get a new job or want to change your withholdings.

Although there’s a new form in town, there’s no need for you or any other existing employees to complete it! Your withholdings will continue based on your previously submitted Form W-4.

Having said that, the new W-4 was created to more closely comply with the “Tax Cuts and Jobs Act” that took effect in 2018. Perhaps now is a good time to conduct a “paycheck checkup” with this online Tax Withholding Estimator Tool to see if your current withholdings need any adjusting

4. You no longer enter in a “number of withholdings” on your W-4.

Remember entering in a somewhat ambiguous number for withholdings that would queue your company’s payroll system to calculate tax credit for dependents? That’s now a thing of the past, as the withholdings box no longer exists on the new form.

If you want to claim credit for dependents, that is now done in Step 3 (optional field) of Form W-4. Children under age 17 are calculated at $2,000/each and other dependents at $500/each.

5. You can more easily identify taxes needing to be withheld from other sources of income.

Because tax liability is based on everything happening in your universe, not just the current job you’re working, the new W-4 allows you to more easily calculate outside sources of income (side gigs, capital gains, interest, retirement payments, etc).

To determine your tax liability, you can either fill in the 2 worksheets included with the new Form W-4 (reduced from 11 in the former version) or use the online Tax Withholding Estimator Tool. *Tip: you’ll get through the online tool much faster with your most recent pay stub(s) and tax return handy, as well as details about your other sources of income.

Once you know your additional tax liability amounts, enter the total in box 4(c) labeled “Extra Withholding” of the new Form W-4.

For more information about the new Form W-4, please visit the IRS’s page of Frequently Asked Questions at https://www.irs.gov/newsroom/faqs-on-the-2020-form-w-4.

Related articles: