The IRS recently announced inflation-adjustment limits for Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) for 2024. These benefits are a great way for employees to save tax dollars on a portion of their earnings.

FSA Contribution Limit for 2024

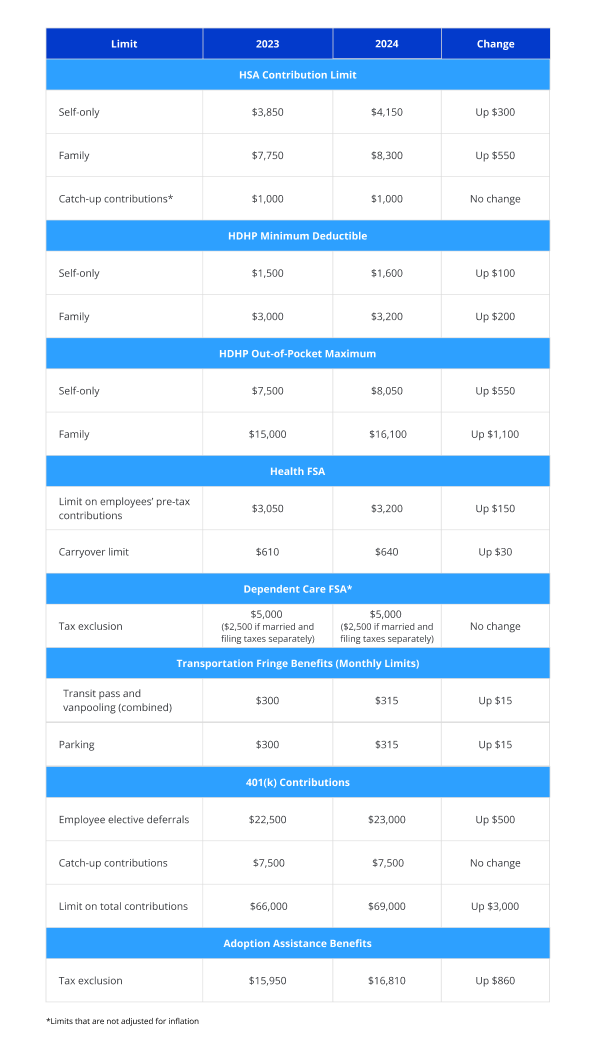

The 2024 health Flexible Spending Account (health FSA) contribution limit for eligible health expenses is $3,200. This is a $150 increase from the 2023 limit of $3,050.

A Flexible Spending Account (FSA) is a tax-advantaged financial account that allows you to set aside a portion of your earnings on a pre-tax basis to cover qualified medical, dental, vision, pharmacy, and dependent care expenses. See our list of common FSA-HSA purchases here.

Employers may continue to impose their own dollar limit to Health FSAs if they would prefer not to offer the IRS maximum. Please contact your HR (Human Resource) department with specific questions about your company’s 2024 Health FSA contribution limit.

FSA Carryover Amount for 2024

Health FSA carryover amounts may be as much as the IRS maximum of 20% of the annual contribution limit threshold. Because employers may also impose their own carryover limits (not to exceed the IRS maximum), you should contact your HR department with specific questions about your FSA carryover amount.

Stratus HR offers an FSA rollover amount of $610 for 2023 plan year dollars rolling into 2024, which will increase to $640 for the 2024 plan year rolling over to 2025.

Dependent Care FSA Contribution Limit for 2024

Once again, the 2024 dependent care FSA contribution limit will remain at $5,000 for single taxpayers and married couples filing jointly, or $2,500 for married people filing separately. Please note that the limit caps at a combined $5,000 for dependent care even if each married person has an employer-sponsored FSA plan available.

The purpose of a Dependent Care FSA is to help employees save money on qualifying childcare or adult dependent care expenses so they can continue to work. To use it, you must contribute pre-tax dollars from your paycheck to fund your account, then use these tax-free dollars when paying for an eligible dependent care expense.

HSA Contribution Limit for 2024

HSA limits for 2024 took a big jump from 2023’s limits. The 2024 limit for self-only coverage is now $4,150, a 7.8% increase from the 2023 limit of $3,850, and the 2024 family limit is now at $8,300, another sizable increase from the $7,750 limit of 2023. Catch-up contributions for participants age 55 and older will remain at $1,000.

Remember, you must have a qualifying High Deductible Health Plan (HDHP) to be eligible for an HSA.

An HSA is like an FSA in that it lowers your taxable income and is used to pay for eligible health care expenses. The differences between an HSA and FSA are:

- An FSA is pre-funded to have your entire balance available January 1. For an HSA, however, you are limited to only using the amount you have contributed so far.

- HSAs have a higher maximum annual contribution limit ($4,150 individual /$8,300 family for 2024).

- Money in your HSA accrues from year to year like a bank account and earns interest. Dollars in your FSA are “use it or lose it” by the end of the calendar year, except for rollover provisions.

- FSA contributions must be pre-determined for the year, whereas HSA contributions can be changed throughout the calendar year.

- You must be enrolled in a qualified HDHP to contribute to an HSA.

If you have an HSA, you can only participate in an FSA if it is a limited-purpose FSA. This means you can only use FSA dollars for dental, vision, and over-the-counter expenses not covered by your health plan.

Who do I ask if I have more questions about FSAs or HSAs?

For more information about FSAs, HSAs, open enrollment, benefits administration, or any other benefits-related questions, please contact your certified HR expert.

Not a current Stratus HR client? Our team can help you navigate the complexities of 2024's tax-free employee benefits. From expert consultations to the latest updates and personalized guidance, we're here to ensure you maximize your benefits and make informed decisions. Book a free consultation today!