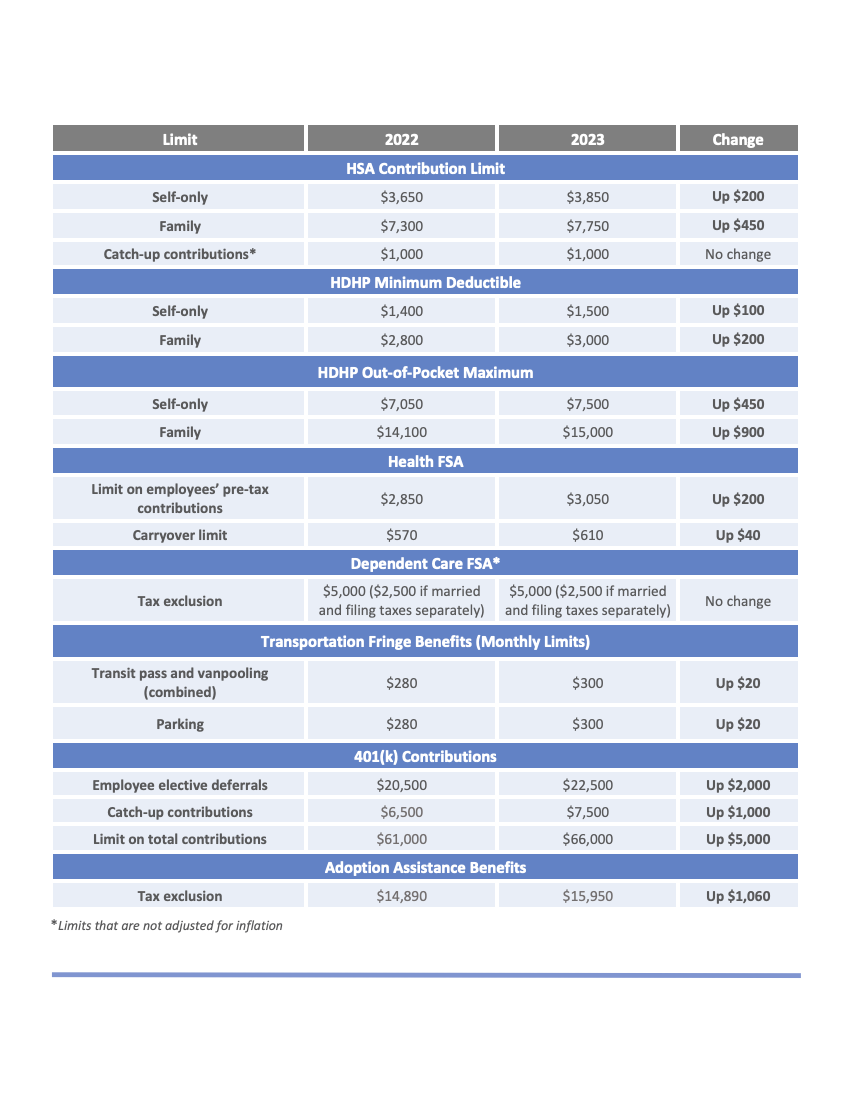

Are you looking for tax shelters in 2023? If you’d like to set aside a portion of your income through eligible tax-free employee benefits, please see the increased contribution amounts below for Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs), 401(k) contributions, fringe benefits for transit and parking, and adoption assistance plans.

Here at Stratus HR, we can help you navigate the complexities of 2023's tax-free employee benefits. From expert consultations to the latest updates and personalized guidance, we're here to ensure you maximize your benefits and make informed decisions. Book a free consultation today!

FSA Contribution Limit for 2023

The 2023 FSA contribution limit for eligible health expenses (health FSA) is $3,050. This account allows you to set aside pre-tax dollars to use for out-of-pocket expenses for eligible medical, dental, vision, pharmacy, and dependent care expenses. By using pre-tax dollars for eligible expenses, you ultimately lower your taxable income, which saves you money. Learn more about FSAs in this video.

Employers may continue to impose their own dollar limit on employee salary reduction contributions to Health FSAs if they would prefer not to offer the IRS maximum. Please contact your HR (Human Resource) department with specific questions about your 2023 Health FSA contribution limit.

FSA Carryover Amount for 2023

While employers can impose their *own limits, the IRS maintains the 20% of annual contribution limit threshold for rollover amounts. Because this is at the employer's discretion, please contact your HR department with specific questions about your FSA carryover amount.

*Stratus HR offers an FSA rollover amount of $610 from 2022 to 2023.

Dependent Care FSA Contribution Limit for 2023

The 2023 dependent care FSA contribution limit will remain at $5,000 for single taxpayers and married couples filing jointly, or $2,500 for married couples filing separately. Please note that the limit caps at a combined $5,000 for dependent care even if each married person has an employer-sponsored FSA plan available.

This type of FSA allows you to pay for dependent care expenses (such as elderly care or child daycare) with pre-tax dollars contributed into your account. The money can then be used tax-free when paying for an eligible expense.

HSA Contribution Limit for 2023

HSA limits for 2023 will increase to $3,850 for self-only coverage and $7,750 for family. Catch-up contributions will remain at $1,000. Remember, you must have a qualifying High Deductible Health Plan (HDHP) to be eligible for an HSA.

An HSA is like an FSA in that it lowers your taxable income and is used to pay for eligible health care expenses. The differences between an HSA and FSA are:

- An FSA is pre-funded, meaning your entire balance is available January 1. For an HSA, however, you are limited to only using the amount you have contributed so far.

- HSAs have a higher maximum annual contribution limit ($3,850 for 2023).

- Money in your HSA accrues from year to year like a bank account and earns interest. Dollars in your FSA are “use or lose” by the end of the calendar year, except for rollover provisions.

- FSA contributions must be pre-determined for the year, whereas HSA contributions can be changed throughout the calendar year.

- You must be enrolled in a qualified HDHP to contribute to an HSA.

If you participate in an HSA, you can only participate in an FSA if it is a limited-purpose FSA. This means you can only use FSA dollars for dental, vision, and over-the-counter expenses not covered by your health plan.

Monthly Limits for Transportation Fringe Benefits in 2023

Fringe benefits for both a transit pass and vanpooling cap at $300 per month in 2023. The maximum allowable parking benefits also increase slightly to $300 per month for 2023.

Maximum 401(k) Contribution Limits in 2023

Employees can elect to defer up to $22,500 towards their 401(k) in 2023. Catch-up contributions for those age 50 or over can contribute an additional $7,500 in 2023, for a total of $30,000 in 401(k) contributions.

Maximum Tax Exclusion for Adoption Assistance Benefits in 2023

If your employer offers an adoption assistance program, the maximum amount that can be excluded from your gross income in 2023 for the adoption of a child is $15,950.

Who do I ask if I have more questions?

For more information about FSAs, HSAs, employer-sponsored 401(k) plans, open enrollment, or any other benefits-related questions, please contact your certified HR expert. Not a current Stratus HR client? Book a free consultation and our team will be in touch with you shortly!