The Internal Revenue Service (IRS) has announced the inflation-adjusted limits for Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) for 2025. These accounts offer significant tax advantages, helping employees save on health and dependent care expenses by understanding the annual contribution limits.

Here’s what you need to know about the updated limits and how to make the most of these benefits.

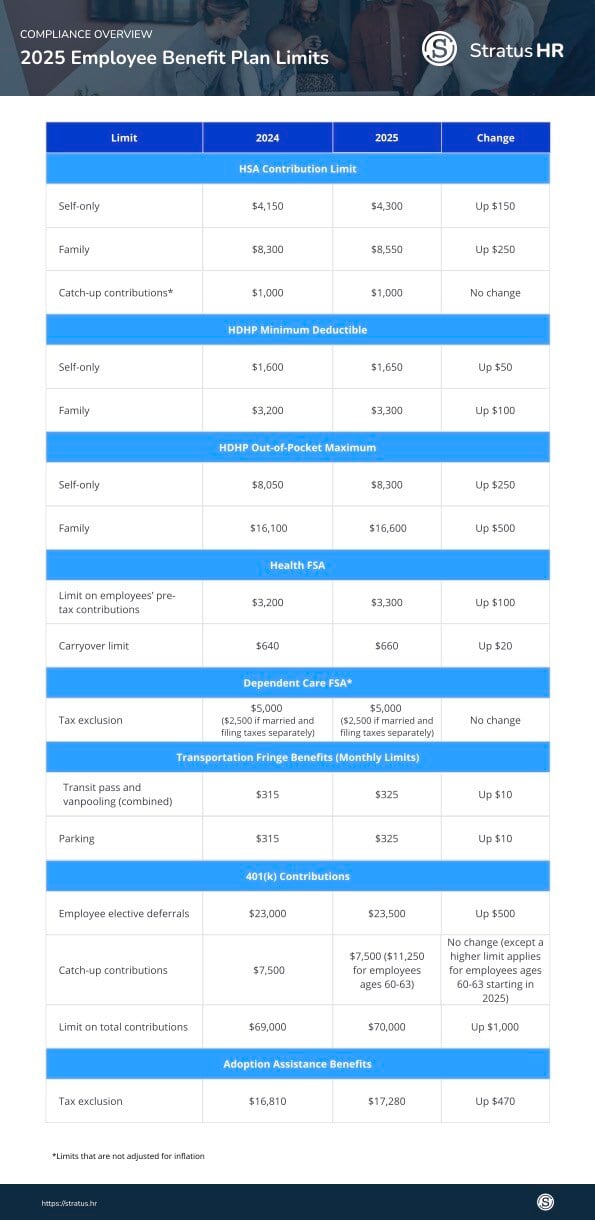

2025 FSA Limits

Health FSA Contribution Limit for Qualified Medical Expenses

The health flexible spending account (FSA) contribution limit for 2025 is set at $3,300, a $100 increase from the 2024 limit of $3,200. Pre-tax dollars contributed to an FSA can be used for qualified health care expenses such as medical, dental, vision, and pharmacy costs. (See our list of qualifying HSA-FSA expenses.)

Health FSA Carryover

For 2025, the maximum carryover amount for a health care FSA is 20% of the annual contribution limit, equating to $660. However, employers may opt to set a lower carryover amount. (Stratus HR offers a full $660 carryover from the 2025 plan year into 2026.)

Dependent Care FSA Contribution Limit for Dependent Care Expenses

The dependent care FSA limit remains unchanged for 2025:

- $5,000 for single taxpayers and married couples filing jointly

- $2,500 for married individuals filing separately

These accounts are invaluable for offsetting expenses for child or dependent adult care, allowing employees to work while managing caregiving responsibilities. Eligible expenses include daycare, preschool, and summer camps for children, as well as adult daycare services for dependent adults.

HSA Contribution Limits for 2025

The health savings account (HSA) limits have increased slightly for 2025, offering even more savings opportunities:

- Individual coverage: $4,300 (up $150 from 2024)

- Family coverage: $8,550 (up $250 from 2024)

- Catch-up contributions (for those 55+): $1,000

Funds in an HSA can be used to pay for eligible medical, dental, and vision expenses without incurring taxes, provided they are used for qualified medical expenses.

To contribute to an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). HSAs provide several advantages over FSAs, including the ability to rollover unused funds year to year, earn interest, and change contributions throughout the year.

Key Differences Between FSAs and HSAs

While both FSAs and HSAs offer tax advantages, understanding their differences can help you choose the best option:

- Funding: FSAs provide access to your full annual contribution on January 1, while HSAs let you use only what you have contributed so far.

- Contribution Limits: HSAs allow for higher maximum contributions, which are $4,300 for individuals and $8,550 for families in 2025.

- Rollover: HSAs roll over all unused funds year to year, while FSAs follow “use-it-or-lose-it” rules with limited carryover.

- Flexibility: FSA contributions are fixed for the year, while HSA contributions can be adjusted throughout the year.

- Eligibility: Only individuals with a high deductible health plan (HDHP) can contribute to an HSA, while FSAs are more broadly available.

Limited-Purpose FSAs for HSA Participants

If you have an HSA, you can still use an FSA, but it must be a limited-purpose FSA. These accounts are restricted to covering dental, vision, and specific over-the-counter expenses not included in your HDHP.

Getting Help with Your Benefits

Consulting with benefits professionals like Stratus HR provides you with experts who can guide you through plan options, open enrollment, and strategies to maximize your savings. If you have questions about FSAs, HSAs, or other tax-free benefits for 2025, please reach out to your certified HR expert.

Not a current Stratus HR client? Book a free consultation and our team will contact you shortly.