*Please note: subsequent COVID-relief legislation has made some of the content in this article no longer applicable.

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law on March 27, 2020, and is intended to help keep employees paid and employer debt obligations funded, despite business setbacks from the Coronavirus. Here’s what you need to know.

CARES Act: Paycheck Protection Program (PPP)

Companies with fewer than 500 employees and other businesses can apply for an emergency SBA-guaranteed loan that may be 100% forgiven when the loan amount is used to maintain payroll for 8 weeks, beginning with when they receive their loan. Costs for payroll, mortgage interest, rent payments, and utility payments (for properties that existed prior to Feb 15, 2020) during those 8 weeks may all be forgiven.

Forgivable payroll costs include:

- Wages (average tips and commissions included)

- Payment for vacation, parental, family, medical or sick leave

- Allowance for dismissal or separation

- Group health care benefits

- Retirement benefits

- State or local tax assessed on compensation of employees

- Certain sole proprietor and independent contractor compensation

These loans require no personal guarantee or collateral. There are no application fees or closing costs, and the availability of credit from other sources will not disqualify eligibility. As the intent is to keep workers employed and paid, anyone that may have been laid off due to COVID-19 can be rehired and paid with wages through this program.

The formula for calculating your PPP max loan amount is:

(Average monthly payroll costs) X 2.5 = total loan amount (capped at $10 million)

To find your average monthly payroll costs, look at your total monthly payments during the 1-year period prior to the date your loan is made and find the average. If you were not in business in 2019, look at your average monthly payroll between January and February, 2020

There are several caps and limitations of PPP loans:

- Employees who make more than $100,000 annually will have their wages capped.

- Loan forgiveness amount will be reduced for any reduction in employee headcount and/or reduction in wages, unless the employer eliminates the reduction in headcount and/or wages by June 30, 2020.

- Employers may not double dip from the refundable tax credits provided by emergency paid sick and FMLA, so any paid leave will be reduced from the loan amount.

Monthly payments are deferred for 6 months with a modest interest rate of 1% and a maturity of 2 years. (UPDATED: April 3, 2020)

CARES Act: Economic Injury Disaster Loan

Companies may also qualify for an Economic Injury Disaster Loan as long as the two loans don’t pay for the same expenses. Check with your lender for more information.

CARES Act: Business Tax Changes

Eligible businesses may also be eligible for:

- Employee Retention Tax Credit (ERTC)

- Delayed payroll tax payments

- Relaxed net operating loss limitations

- A refund for their corporate alternative minimum tax credits

- An increase to their business interest expense deductions on tax returns

- Writing off costs for improving facilities and increasing cash flow

- Exception from the excise tax for alcohol if used to produce hand sanitizer

Talk with your tax professional to know which apply to your business.

Please note: this summary is not all-inclusive. For a more thorough summary, please see the Coronavirus Emergency Loans Small Business Guide and Checklist provided by the U.S. Chamber of Commerce or NAPEO's summary of payroll assistance programs.

The CARES Act may help you pay for 8 weeks of employee wages and business expenses.

Sources:

Treasury.gov

US Chamber

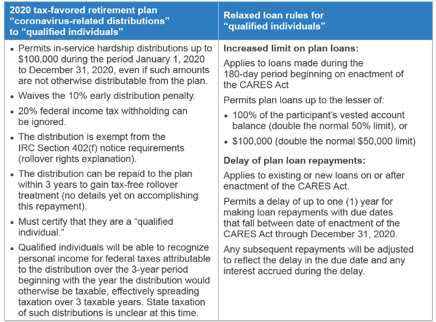

Here's a list of key provisions to the CARES Act that impact qualified retirement plans.

Related articles: