Crafting Competitive Benefits Packages for Emerging Industry Talent

Have you noticed your top employees are looking for more than traditional employee benefits? Here’s how to create more competitive benefits packages.

Compete with larger companies by offering your employees a strong benefits package—all while staying within budget.

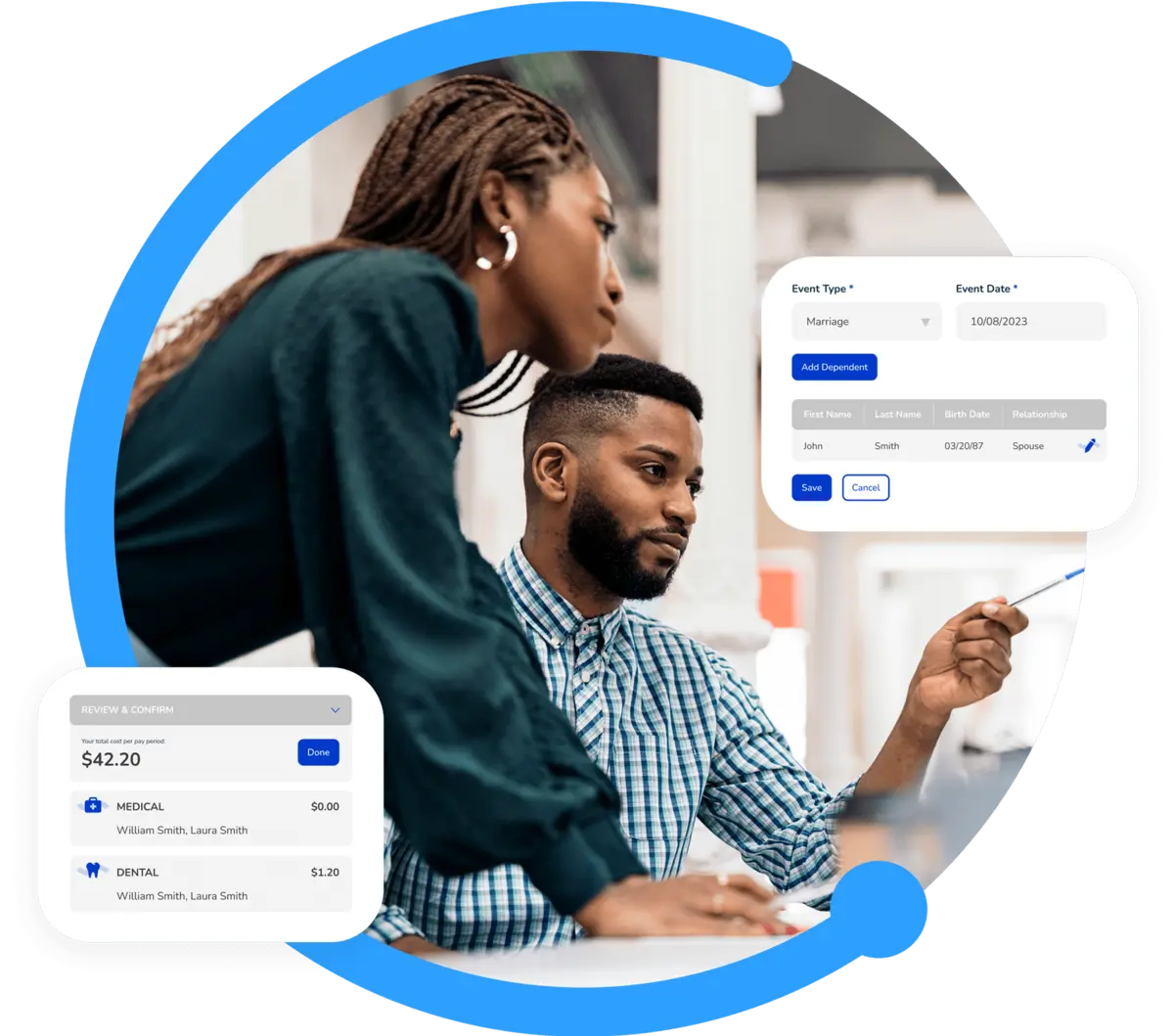

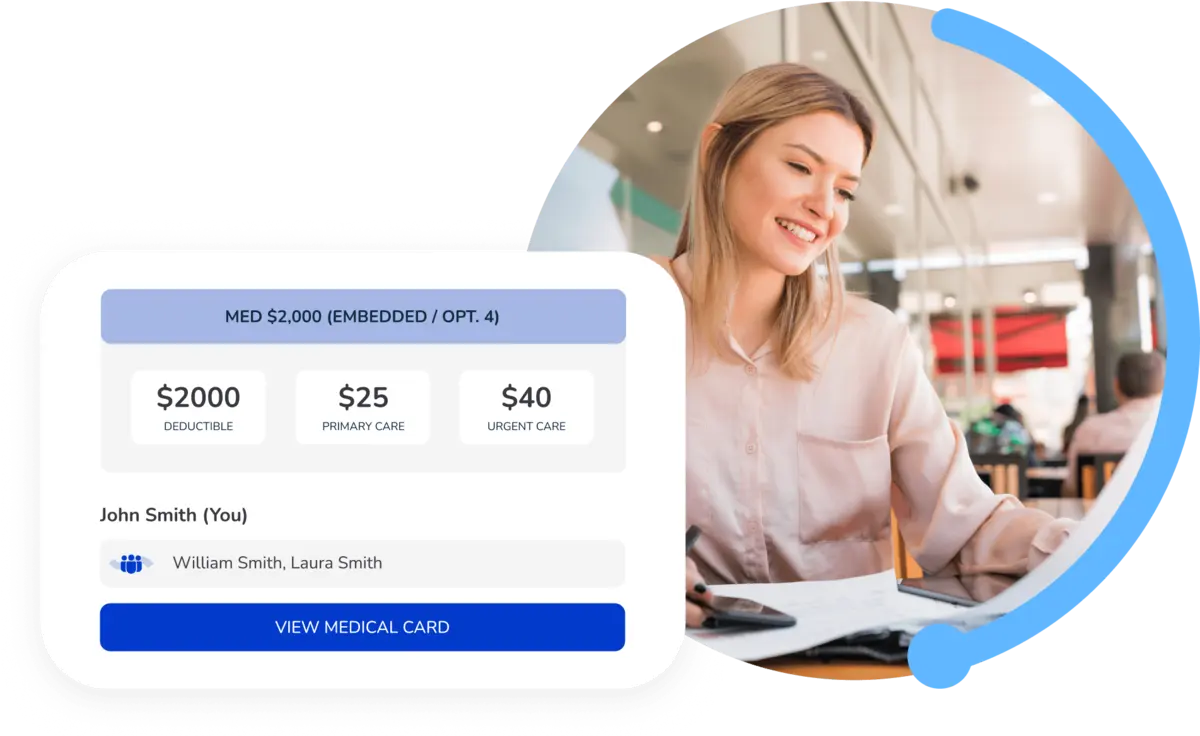

Offer competitive, solid healthcare benefits packages to attract top talent and retain your employees. Minimize the headache of benefits enrollment with Stratus HR’s user-friendly software. Choose from various health insurance plans, retirement opt-ins, and à la carte items such as dental and vision. You can access self-service answers or reach out to your dedicated Stratus support team with any questions.

Access economies-of-scale pricing and offerings to compete with larger companies. Choose from a wide range of health insurance options, including group plans or custom options, savings and retirement, and à la carte products such as flexible spending (FSA), life insurance, dental, and vision. Create the plan that best fits your budget while still offering Fortune 500 benefits to take care of your employees.

Take insurance stress off your plate by relying on your dedicated Stratus HR team. Don't worry about premium leakage ever again. Plus, get pre-tax and post-tax deductions for qualifying plans, reconciliation of benefit plan invoices, support for employee claims, and automatic notifications for eligibility. Rest easy knowing everything is backed up in a secure system, insurance plans are ACA-compliant, and you’ll have COBRA administration for termed employees, where applicable.

Take advantage of online enrollment and access benefit information 24/7 to get answers when you need them. Determine enrollment schedules ahead of time, and your employees will receive automated reminders when it’s time to enroll. They can access benefit information online or using the Stratus HR mobile app. Get support through multiple channels, including the SMS, your online portal, Stratus HR chat, or schedule a consultation with your dedicated representative.

Stratus HR will partner with your broker to ensure everything is seamless, working in the background to offer support when needed. If you don’t have a broker, we’ll be your brokerage, offering large-group insurance options or helping you procure custom-fit health plans that are right for your organization.

Have you noticed your top employees are looking for more than traditional employee benefits? Here’s how to create more competitive benefits packages.

Let’s say your company offers a 401K with both Traditional and Roth investment options. Which one should you choose?

While it may not be your job to solve employees’ physical and mental health problems, you can enhance workplace mental health by being open and...